Effective Internal Control Over Cash Includes the Requirement That

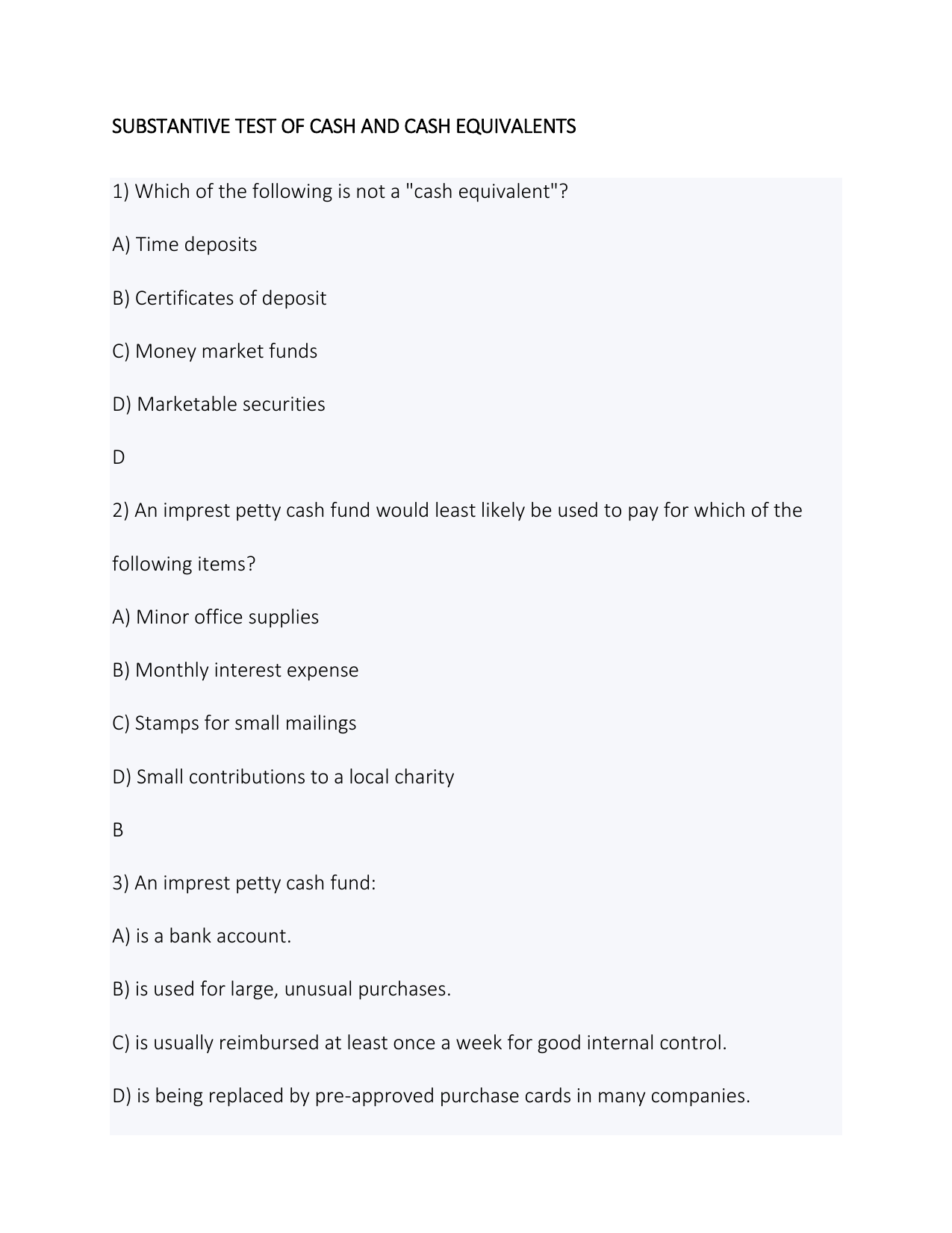

This control measure is possible in all but the smallest companies. A Only checks are used for payment of purchases.

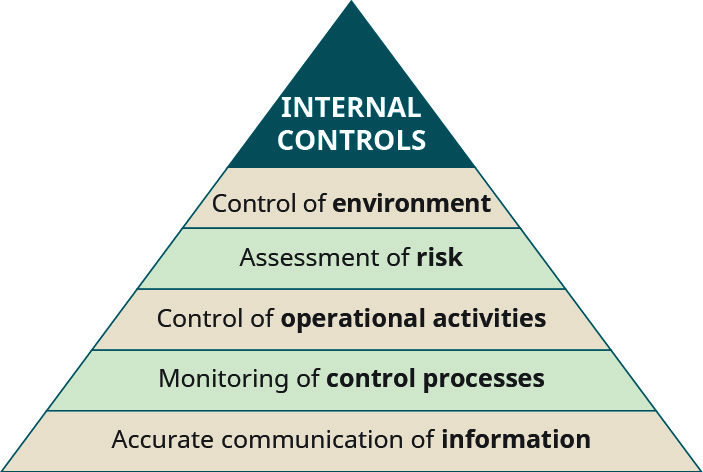

What Are Internal Controls Types Examples Purpose Importance

B The same person who makes deposits should also record the deposits.

. Physical security such as locking premises personal offices filing cabinets and safes etc. The duties of authorization signing a check or releasing a wire transfer custody having access to the blank check stock or the ability to establish a wire transfer and. Effective internal control over cash includes the requirement that.

Ensure the quality of internal and external reporting which in turn requires the maintenance of proper records and processes that generate a flow of timely relevant and reliable information from both internal and external sources. For information about cash handling responsibilities contact the Cashiers Office 858 534-3725. Another weakness in internal control over cash disbursements is that the Idaho Company uses checks that are not pre-numbered.

Using security cameras. Effective internal control provides bankers and examiners reasonable assurance that Bank operations are efficient and effective. This control feature follows the general principle of segregation of duties given earlier in the chapter as does the next principle.

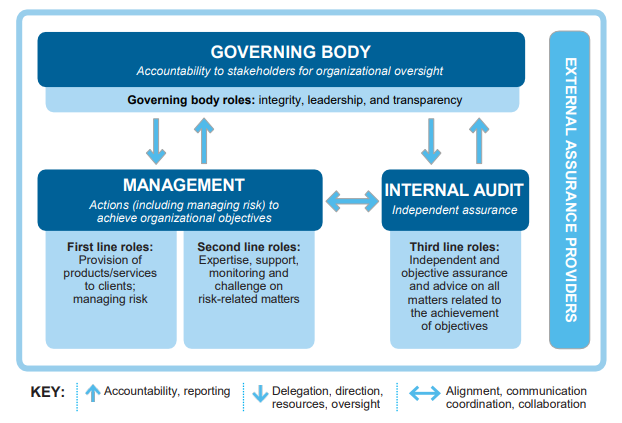

Risk management systems are effective. Ing systems of internal control and for understanding requirements for effective internal control. Also the Framework reflects considerations of many changes in the business and operating environments over the past several decades including.

Companies also need controls over cash disbursements. Here are five items to consider when evaluating your internal controls over cash disbursements. For information on internal control practices contact Arlynn Renslow 858 822-2968.

Once the total deposit is calculated the deposit can be made by one person. The same person who makes deposits should also record the deposits О The person who makes deposits should NOT record the deposits. An effective internal control structure includes a companys plan of organization and all the procedures and actions it takes to.

Basically the assessment of internal control consist of two aspects. A The person who makes deposits should NOT record the deposits. The bank complies with banking laws and regulations internal policies and internal procedures.

Ensure compliance with company policies and federal law. The establishment and maintenance of an effective internal control structure mainly depend on the management. There are different practices that are suggested so as to safe guard the Internal Control Procedures for Cash and they include having people who.

Since a company spends most of its. Effective internal control over cash includes the requirement that. 5 key internal controls.

There are five ways your organization can strengthen its internal controls over handling cash. The Institute of Internal Auditors control environment definition states that the control environment is the foundation on which an effective system of internal control is built and operated in an organization that strives to 1 achieve its strategic objectives 2 provide reliable financial reporting to internal and external stakeholders 3 operate its business efficiently and. This should be monitored to ensure only the right personnel have access to handling cash.

Defines internal control as a process effected by an entitys board of directors management and other personnel designed to provide reasonable assurance regarding the achievement of objectives relating to operations reporting and compliance2 INTERNAL CONTROL OVER FINANCIAL REPORTING ICFR refers to the controls specifically designed to address risks. Internal control is designed to provide reasonable assurance of the achievement of objectives by mitigating significance general and specific risks. The other steps to be taken include.

Protect the organizations cash on hand by placing them in a locked cabinet or drawer with limited access or better yet a drop safe. The foundation of a good internal control system is segregation of duties. Inaccurate application of cash receipts to department accounts.

Having individuals who follow-up. Effective internal control over cash includes the requirement that. Collect and deposit cash verify cash payment to receivable records reconcile cash receivables to receivable documentations bill for services and goods.

The adequacy of the design of internal control. Evaluate the performance of all personnel to promote efficient operations. Recorded transactions are accurate.

This includes safeguarding of assets and ensuring that liabilities are identified and managed. The under-mentioned three parties have definite roles in making the internal control system effective. Types of control techniques used to protect assets include.

Objectives to include other important forms of reporting such as non-financial and internal reporting. Arrange duties so that the employee who receives the cash does not disburse the cash. Physical assets include cash stock and equipment and non-physical assets could include debtors intellectual property or customer lists.

View Answer In a. Another effective internal control is the two person rule. Effective internal control over cash includes the requirement that.

This can cause some major errors in a company because there is no way to track for any missing checks or to know if a previous check was. If a truly small. C The person who makes deposits should NOT record the deposits.

Or in financial audit engagement internal control is designed to prevent or detect material. Multiple Choice Only checks are used for payment of purchases. D a and b.

However the deposit slip is sent back to the other person for confirmation of the correct deposit amount. Ideally two people process the cash receipts together generate the ledger together and fill out the forms together. Idahos Company should use checks that are numbered as well as imprinted with the amount in inedible ink.

C Only checks are used for payment of purchases. It is the general responsibility of all employees officers management of a company to follow the internal control system. D Only checks are used for payment of.

Lost or stolen cash receipts. Financial reporting is reliable. B The same person who makes deposits should also record the deposits.

Cash registers time clocks and personal identification scanners are examples of technologies that can improve internal control. Protect its assets against theft and waste.

Internal Controls Acca Qualification Students Acca Global

Au 319 Consideration Of Internal Control In A Financial Statement Audit Pcaob

Audit Deficiencies Related To Internal Control The Cpa Journal

Au 319 Consideration Of Internal Control In A Financial Statement Audit Pcaob

Define And Explain Internal Controls And Their Purpose Within An Organization Principles Of Accounting Volume 1 Financial Accounting

Cash And Internal Control Financial Accounting

Part 5 Entity Level Controls Demystifying Sox 404

What Are Internal Controls Types Examples Purpose Importance

Office Of Internal Audit The Three Lines Of Defense Office Of Internal Audit

What Are Internal Controls Types Examples Purpose Importance

Comments

Post a Comment